[ad_1]

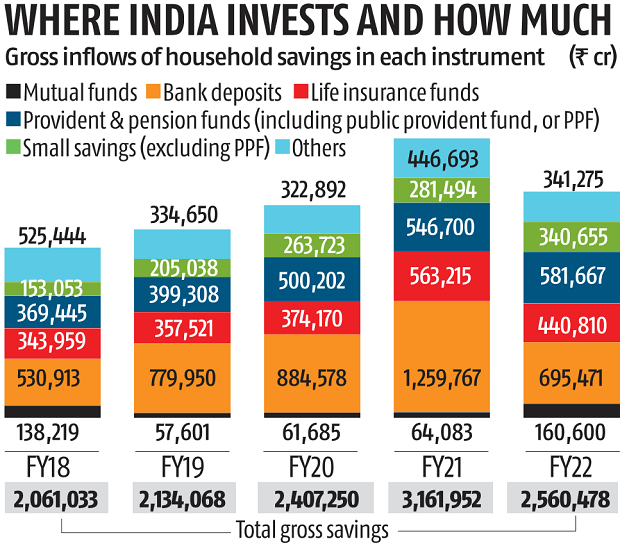

Mutual funds (MFs) recorded a 150 per cent jump in gross inflows from retail investors during 2021-22 (FY22), even as overall household savings declined 19 per cent year-on-year.

In FY22, domestic MFs received Rs 1.6 trillion gross inflows from households, revealed data released by the Reserve Bank of India (RBI).

Given that households saved a total of Rs 25 trillion in the last financial year, the share of MFs in total gross savings stood at 6.3 per cent — the highest in four financial years. In fact, gross inflows into MFs were the highest in at least a decade.

Experts say the rise in MF investments shows that people in the formal economy and those with additional income weren’t as badly hit by inflation as the lower income groups.

“The fall in bank deposits and rise in investments in MFs, along with provident and pension funds, indicates that the salaried class and those with additional income have been able to increase their investments, while lower income groups that mostly invest in bank deposits were hit by inflation,” says Dhananjay Sinha, director and head-research, strategy & economics, Systematix Institutional Equities.

The massive rise in MF inflows comes on the back of a strong rally in equity markets and poor inflation-adjusted returns for other asset classes.

The systematic investment plans (SIPs) offered by MFs proved to be a big source for channelling household savings into MFs.

According to the Association of Mutual Funds in India data, the industry onboarded over 10 million new investors and received a total of Rs 1.2 trillion through SIPs in FY22.

There is also an understanding in the industry that there is a growing maturity among investors as flows into MFs remain strong, even during bouts of heightened volatility.

“There is growing maturity among investors. A decade ago, one may have anticipated sharp redemptions during periods of negative returns. However, there is now a larger body of seasoned investors willing to increase their equity allocation when valuations get more attractive, following periods of correction,” says Vishal Kapoor, chief executive officer (CEO), IDFC Asset Management Company.

Bank, pension, and insurance take lion’s share

Bank deposits by retail investors may have plunged 45 per cent year-on-year in FY22, but they still accounted for 26 per cent of gross household savings at Rs 6.9 trillion.

Provident and pension funds (including public provident fund) had the second highest share at 23 per cent, followed by life insurance funds (17 per cent) and small savings schemes (13 per cent), according to the RBI data.

This shows that MFs are still only the fifth preferred investment option of retail investors despite their share in total household savings rising from 2 per cent to 6 per cent within a year.

MFs’ strong showing continues

MFs remain on a high growth path in FY23 as well. The industry added close to 7 million investor accounts in the first five months of the current financial year (2022-23), bringing the total to 136.5 million.

The sharp increase in MF folio count implies that a lot of new investors are coming into the capital markets and embracing MFs as their preferred vehicle for investing.

“Investors are moving from pure deposits to newer alternatives as evident from the rising inflows in MFs and opening up of a high number of dematerialised accounts,” says Suresh Soni, CEO, Baroda BNP Paribas MF.

[ad_2]

Source link